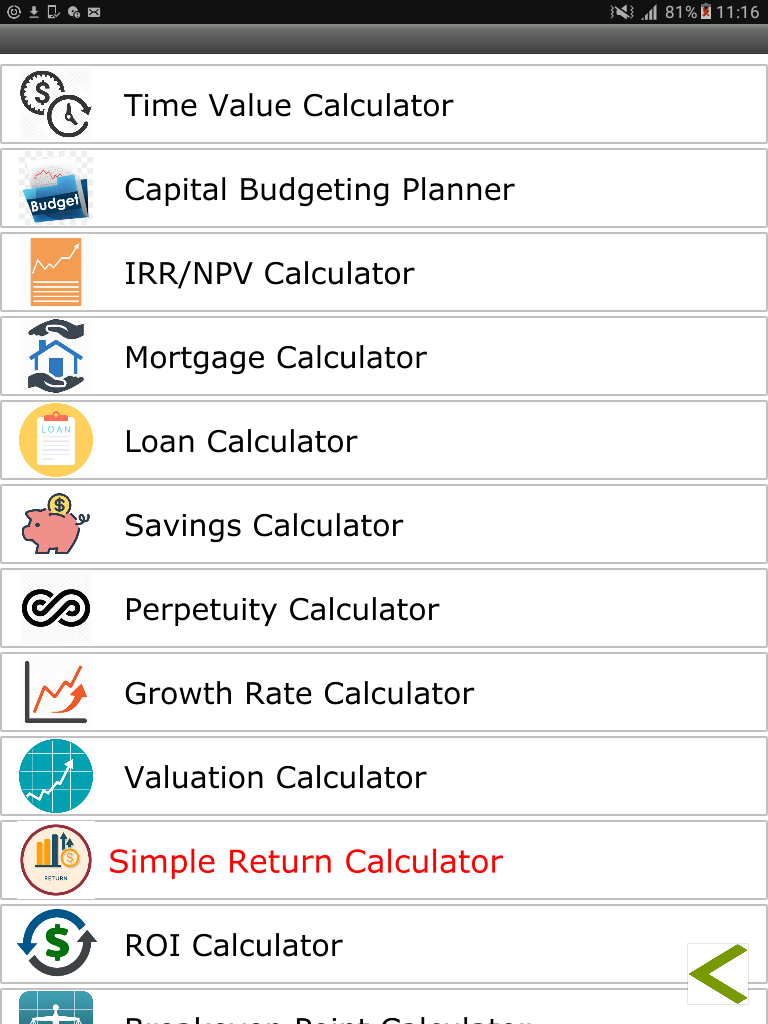

Boachsoft Plata is a financial app developed by Boachsoft. It is different from Boachsoft Finance. Boachsoft Finance is a personal finance software whereas Boachsoft Plata provides users with an excellent set of calculators for financial decision making. It does not store any data. It just aids your calculations. It is the ideal financial app for investors in equities, creditors, finance officers, entrepreneurs and small business owners. You can also use it to plan for your retirement.

Studies have proven that firms that borrow money out-perform those that don’t. This concept is called financial leverage. This may appear counter-intuitive because of the interest payments or the cost of capital. Running your business with borrowed funds increases profits. The more money that is borrowed the greater the net income. However, for every business borrowing beyond a certain threshold reduces the profits.

Boachsoft Plata has a loan calculator. This allows you to calculate the fixed periodic payments required to amortize any loan. The periodic payments usually coincide with the compounding period. For example, for loans compounded annually the periodic payments that would be calculated would be the annual payment required to amortize it. Likewise, for loans compounded monthly the calculated value is the monthly payment.

To use the loan calculator in Boachsoft Plata, select Menu and then Loan Calculator. One unique feature of Boachsoft Plata app is that it allows you to calculate any of the variables required for loan computations. Just leave out one and supply the rest and the value would be calculated for you. To calculate the quarterly payment required to amortize a loan compounded quarterly first enter the loan principal in the Loan Amount field. Enter the annual interest rate, also called annual percentage rate (APR), in the Annual Interest field. In the dropdown list box at the bottom select Compounded Quarterly. The number of periods field should change to Quarters. Enter the loan term in quarters. For example, for a six year loan term compounded quarterly the number of periods would be 4 multiplied by 6 which is 24. Enter 24 in the quarters field. Press the Quarterly Payment button to calculate the quarterly amount required to amortize the loan in 6 years. The total interest that would be paid would also be displayed.

You can use the loan calculator as an aid in making financial decisions. However, the software has a better tool that can help any small business increase profits. It is called the Capital Budgeting Planner. You can use this tool to determine the viability of every investment you make in your business.

Open the Boachsoft Plata app. Select Menu and then the Capital Budgeting Planner. A capital expenditure is any project that is expected to provide your business with returns over a period greater than a year. You would need to gather some data in order to use this planner well. First find out from your financial institution the cost of capital. Determine the amount of money that must be sunk into the project. This is the amount of money that you plan to invest. It is also called the initial outlay. Next, for each of the subsequent years calculate the net cash inflow.

Enter the cost of capital in the Cost of Capital field. It is located in the set of fields to your right. You should see Drag/Scroll on top of the column. If it is not visible simply drag it until it is full visible. Don’t enter the percent sign.

Enter the initial investment you are going to make in the cash flow field next to year zero but precede it with a negative sign because it is an outflow. The negative sign is called a minus sign (-). Enter the expected cash flow for each year in the corresponding field. You would see the year in the column labeled year. Most, if not all, would be inflows. If you expect a net cash outflow then precede it with a negative sign.

Press any of the buttons to your right to calculate the relevant values. Drag it into place if it is not visible. NPV is simply the net present value of your project. IRR is the internal rate of return of your investment. The payback period calculates the approximate number of years it will take you to recoup your initial investment without taking into consideration the cost of capital. EAA means equivalent annual annuity. It simply converts your cashflows into a constant annuity.

With the information in the right column you can determine whether a proposed investment is feasible, viable, desirable or costly to the firm.

The payback period is an unsophisticated method of determining the viability of projects. A project with a payback period of say 2.5 years simply means that after 2 years 6 months the investment should have generated the amount of money invested. It does provide a fair means of assessing the viability of projects but it does not take into consideration the cost of capital.

The net present value (NPV) tells you whether the project is going to generate profits or not. It calculates the present value of the profits that would be generated. It does take into consideration the cost of capital. It is a sophisticated method of determining the viability of projects just like the internal rate of return (IRR). The IRR tells us the cost of capital or the discount rate which would result in an NPV of zero. So far as the IRR is greater than the cost of capital the project would be profitable.

Armed with these tools in Boachsoft Plata, a small business owner who consistently selects the best projects using the Capital Budgeting Planner should increase his or her profits by over 200%.

Boachsoft Plata is currently available in English, Spanish, German and Italian. It will be translated into more languages. It is absolutely free.

To purchase this ebook on online startup secrets click on the image above.

Click the following link to install Boachsoft Plata from the Google Play Store. Boachsoft Plata financial app

Click the following link to visit the home page. Excellent financial calculators

Credit: Yaw Boakye-Yiadom